Some of 91原创 Island’s smallest communities saw some of the biggest increases in property assessments this year, as an influx of homebuyers spilling out of larger centres combined with low housing inventory drove up home prices.

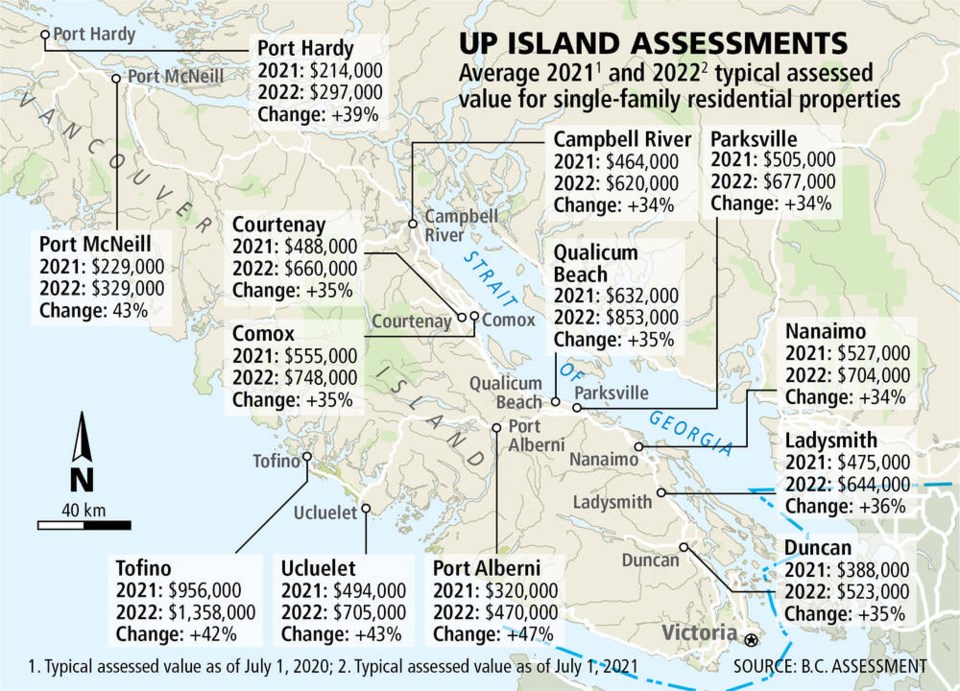

While major centres such as Greater Victoria and Nanaimo saw assessment increases in the range of 22 to 35 per cent for typical single-family homes, smaller communities such as Port Alberni saw increases jump by as much as 47 per cent.

It’s an exciting time, said Port Alberni Mayor Sharie Minions.

She said there has been a noticeable increase in the number of people moving to the Alberni Valley from places such as Victoria and 91原创 and from places further east.

“We’re seeing a variety of people moving to the community,” said Minions, who recently sold her home to a couple from Ontario. “There’s that group of people being priced out of 91原创 moving to Victoria, and people being priced out of Victoria moving to Nanaimo and so on down to the smaller communities like Port Alberni.”

However, she said they have also seen evidence that a lot of locals, younger families and first-time buyers from within the community, have been able to buy in the valley, as home prices remain fairly reasonable despite the increased demand.

Minions said she was heartened by a recent real estate report produced by a local firm showing many of the recent sales were to young people from Port Alberni.

“That’s really encouraging, because as we do start to see a lot more demand in our community, we certainly don’t want those who have always lived here and have built their lives here to be displaced,” she said.

“So it’s a variety, which is really nice, because we don’t want just one type or demographic, we want to build a complete community with a variety of types of people who have a variety of needs for lifestyle.”

A typical home in Port Alberni is now valued at around $470,000, versus $704,000 in Nanaimo and the four municipalities in Greater Victoria where the typical home is now assessed at over $1 million.

Around the mid-Island region, increases in assessed value ranged from 34 to 47 per cent, with a typical home in Duncan seeing an increase of 35 per cent to $523,000, Nanaimo jumping 34 per cent to $704,000, Qualicum Beach increasing 35 per cent to $853,000 and Tofino increasing 42 per cent to $1.36 million.

Tofino Mayor Dan Law said it’s a simple question of supply and demand for real estate on the Island’s west coast. “There’s very little supply and a great demand,” he said. “And Tofino appeals to a certain group of people who have the means to acquire homes at a very high price.”

Law said the community is experiencing growth in both year-round and seasonal residents, and he estimates it has grown by about 20 per cent since the last census. He said an increase in school enrolment suggests there are more young families trying to stay in Tofino.

“But it’s getting difficult,” he said, pointing to the increased home prices.

Law said it’s troubling that property values are quickly getting out of reach for many people in the district.

Ian Mackay, president of the 91原创 Island Real Estate Board, said the assessment jump in the mid and north Island is the result of an exodus from the cities during the pandemic.

“It is people wanting more space and to get out of town where they can work remotely, and that’s really driven things up in those communities.”

Mackay said from what he’s seen, it hasn’t caused hardship for local residents yet, as the residential market is still relatively affordable.

“The difficulty right now is for a seller that may want to sell and downsize, but we don’t necessarily have the correct property or product mix for them to transition to,” he said, noting the supply problem does not discriminate between locals and out-of-towners.

And Mackay said there’s no sign that will change in 2022.

“We really can’t see a short-term solution coming our way — increasing inventory takes time,” he said. “We need all three levels of governments to get on board with finding a solution to the inventory issue.”

The big increase in assessments reinforces to young or first-time buyers how difficult it has become to get into the market, said Mackay, who also reminded homeowners that increased valuations do not necessarily translate into higher property taxes.

Minions said she has tried to get the word out that it’s not the change in a home’s value that drives a tax increase or decrease, but the change relative to the community average.

She said while assessments might be up 47 per cent in Port Alberni, property tax increases are expected to be between one and five per cent.

“A 47 per cent increase in property assessments does not mean a 47 per cent increase in property taxes,” she said, noting the mill rate will be adjusted down and the district will tax only what its budget requires.

Law said most municipalities would have been raising property taxes this year and into the future anyway to deal with aging infrastructure around the province.

“There’s a lot of aging infrastructure that has quite profound consequences on municipalities.”