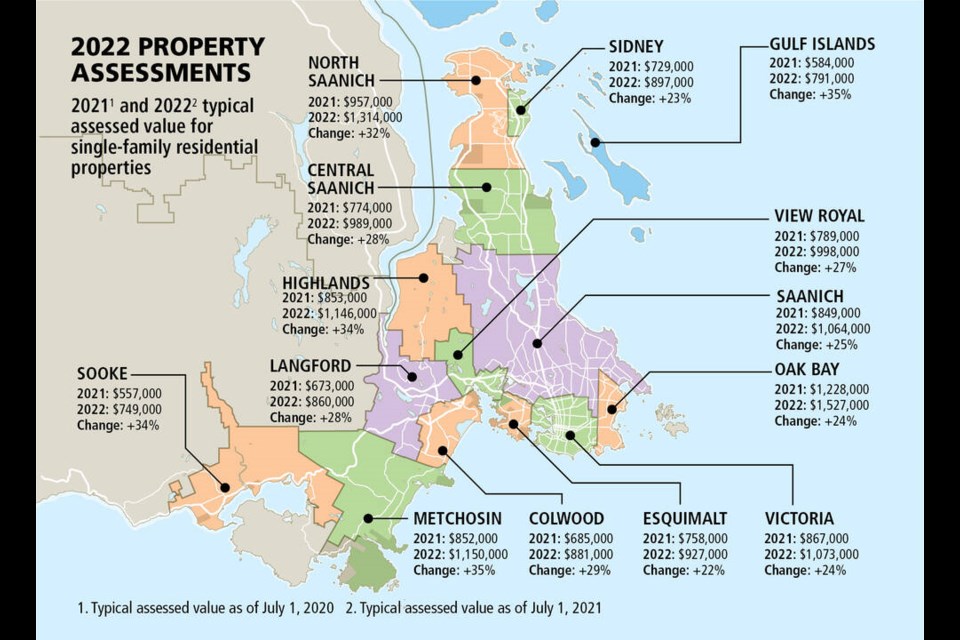

Greater Victoria’s homeowners will see their annual property assessments increase by an average of 22 to 35 per cent when notices start hitting mailboxes this week.

B.C. Assessment, which has mailed out just over 382,000 assessment notices across 91原创 Island and about 2.1 million provincewide, said Greater Victoria homeowners will see assessments that reflect a real estate market with soaring prices amid high demand and low inventory.

“On 91原创 Island, we’ve seen increases anywhere from 15 to 35 per cent across all property types — that’s residential, single-family homes, strata homes, commercial, industrial properties, and anywhere from 20 to 35 per cent increases for single-family dwellings,” said Island deputy assessor Jodie MacLennan.

“I really think that’s due to demand. 91原创 Island is a beautiful place to live and there’s very limited supply.”

Every municipality on the Island saw a large double-digit percentage increase in assessed values, with Port Alberni recording the highest increase at 47 per cent. The typical assessed value of a single-family home there was $470,000, up from $320,000 a year ago.

The smallest increase was 17 per cent in Zeballos, where a typical home was assessed at $127,000.

In the capital region, the largest increase was 35 per cent in Metchosin, where a typical house was assessed at $1.15 million, up from $852,000.

The smallest was 22 per cent in Esquimalt, where a typical home was assessed at $927,000, up from $758,000.

The assessment is the estimate of a property’s market value as of July 1, 2021, and physical condition as of Oct. 31, 2021. B.C. Assessment said changes in property value reflect movement in the market and can vary greatly from property to property.

To determine value, assessors take into account current sales in an area as well as the size, age, quality, condition, view and location of a property.

With assessments jumping significantly, the province is expected to announce this week an increase in the 2022 Home Owner Grant threshold to ensure the same percentage of B.C. homeowners — more than 90 per cent — continues to be eligible for the grant.

Last year, the threshold was $1.65 million. Homeowners in Greater Victoria last year could qualify for up to $570 for the basic Home Owner Grant, and as much as $845 for homeowners who are 65 years or older.

Casey Edge, executive director of the Victoria Residential Builders Association, said soaring assessments should come as no surprise in a region where only a few municipalities, such as Langford, are carrying their weight when it comes to building new homes to deal with demand.

“Boosting housing supply is critical to address rising prices,” he said. “Builders are saying it takes months to obtain a simple building permit without variances. This is an issue of basic administrative efficiency, not rezoning. Municipalities must become more efficient.”

Edge noted Housing Minister David Eby had said he would withhold funding for municipalities obstructing supply, but there’s been no movement on that.

“Obstruction and rising costs continue and we have yet to see any action from the provincial government,” Edge said. “Hopefully the upcoming municipal elections in October will provide an opportunity for candidates to run that support administrative efficiency and more housing supply.”

Strong demand and low supply also played a role in the sharp increase in assessments for strata properties such as condos and townhouses.

On the Island, the typical strata property’s assessment increased from 13 per cent in Victoria and View Royal to 27 per cent in Courtenay.

Big changes in assessed value do not necessarily mean a change to property taxes, MacLennan said.

“As indicated on your assessment notice, how your assessment changes relative to the average change in your community is what may affect your property taxes,” she said.

MacLennan also noted B.C. Assessment does not expect a rash of appeals due to the large increases in assessed value.

“Typically, over 98 per cent of property owners accept their property assessments without proceeding to a formal, independent review of their assessment,” she said. “We’re not expecting anything different for the coming year.”

Those who feel that their property assessment does not reflect market value as of July 1, 2021, or who see incorrect information on their notice, are advised to contact B.C. Assessment. If they are not satisfied after that, they are advised to submit an appeal.

Property assessment review panels, which are independent of B.C. Assessment, are appointed annually by the province and meet between February and March 15 to hear complaints.

The deadline to file an appeal of an assessment is Jan. 31.

Overall, the Island’s total assessments increased from about $269 billion in 2021 to $343 billion this year. About $4.85 billion of the region’s updated assessments is from new construction, subdivisions and the rezoning of properties.

The most highly assessed residential property in the capital region was once again James Island, at $54.7 million — though it did lose some value since last year, when it was assessed at $57.98 million.

The most valuable single-family home remains 3160 Humber Rd. in Oak Bay, assessed at $17.875 million, up from $13.9 million last year.

The total value of real estate on the provincial roll is about $2.44 trillion, an increase of nearly 22 per cent from 2021. New construction, rezonings and subdivisions accounted for $33.9 billion of that roll.

If you can’t wait for the assessment in the mail, notices are online at .