The space technology firm that got its start in Richmond has secured a sky-high selling price of US$6.4 billion.

Maxar Technologies (NYSE:MAXR) (TSX:MAXR) revealed Friday it’s the target of an all-cash deal that would see it acquired by global equity firm Advent International, with British Columbia Investment Management Corp. (BCI) taking a minority stake worth US$1 billion.

The Victoria-based institutional investor provides investment management services to B.C.’s public sector and contributes to investment returns on 715,000 pension plan beneficiaries.

Maxar was of Colorado-based DigitalGlobe Inc. and the Richmond aerospace firm originally known as MacDonald, Dettwiler and Associates Ltd. (MDA). The 91原创 company was best known for developing the Canadarm robotic instrument used on space shuttles.

The goal of the merger was to give MDA greater access to lucrative American defence contracts by reincorporating as a U.S. company with American leadership.

Within three years unit to a Toronto-based consortium led by Northern Private Capital.

MDA Ltd. (TSX:MDA) is now headquartered in Brampton, Ont.

Advent has agreed to buy all of Maxar’s common stock for US$53 a share – a premium of 129 per cent over the company’s closing stock price of US$23.10 Thursday on the New York Stock Exchange.

Maxar’s shares were trading as low as US$5 in the years that followed the MDA and DigitalGlobe merger after initially trading as high as US$65.

The deal has yet to close and Maxar’s board has 60 days to solicit acquisitions from other potential buyers. If a buyer comes around with a better deal, the board will have the right to end the deal with Advent.

If no alternative buyers emerge, the deal is expected to close in mid-2023, pending regulator and shareholder approval.

Maxar said expects to continue using the same brand and remain headquartered in Colorado if the deal goes through.

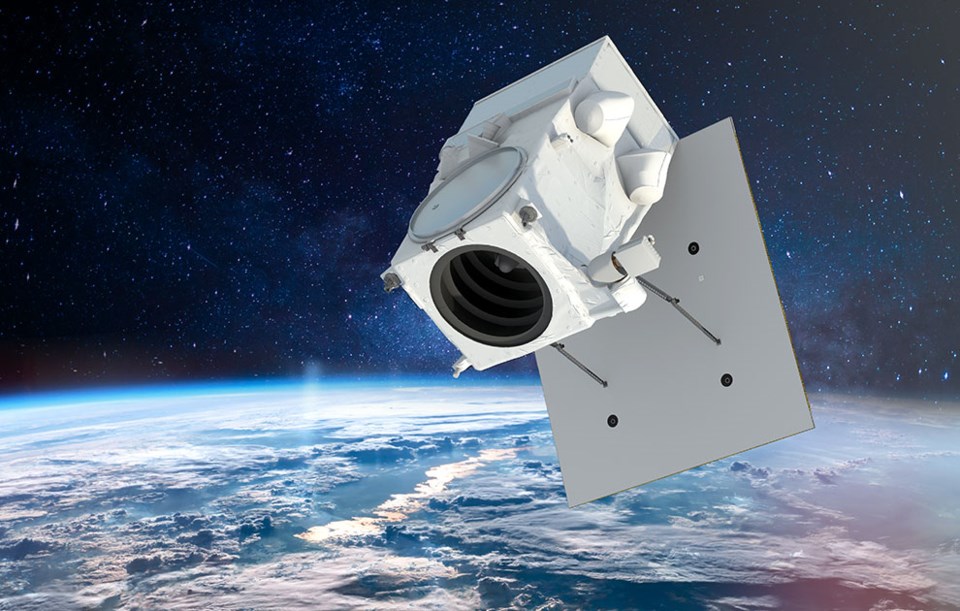

“In our view, Maxar is a uniquely positioned and attractive asset in satellite manufacturing and space-based high-resolution imagery, with an incredible workforce and many opportunities ahead,” Shonnel Malani, managing director of Advent’s aerospace and defence team, said in a statement.

“Our goal is to invest in expanding Maxar’s satellite constellation as well as supporting Maxar’s team to push the boundaries of innovation, ensuring mission success for its customers.”