With new heavy oil and liquefied natural gas terminals and a new hydroelectric dam nearing completion, as well as new green hydrogen production and biodiesel refineries in the works, and carbon capture companies reaching $1 billion valuations, British Columbia has become quite the energy and clean-tech powerhouse.

Roughly $90 billion worth of energy mega-projects are nearing completion in B.C. – the Trans Mountain pipeline expansion, the LNG Canada and Coastal GasLink pipeline, and Site C dam – with tens of billions of dollars of further investments still to come in other energy projects in the queue, including two LNG terminals led by First Nations (Cedar and Ksi Lisims LNG), green hydrogen and ammonia production proposals, and new renewable energy and transmission projects.

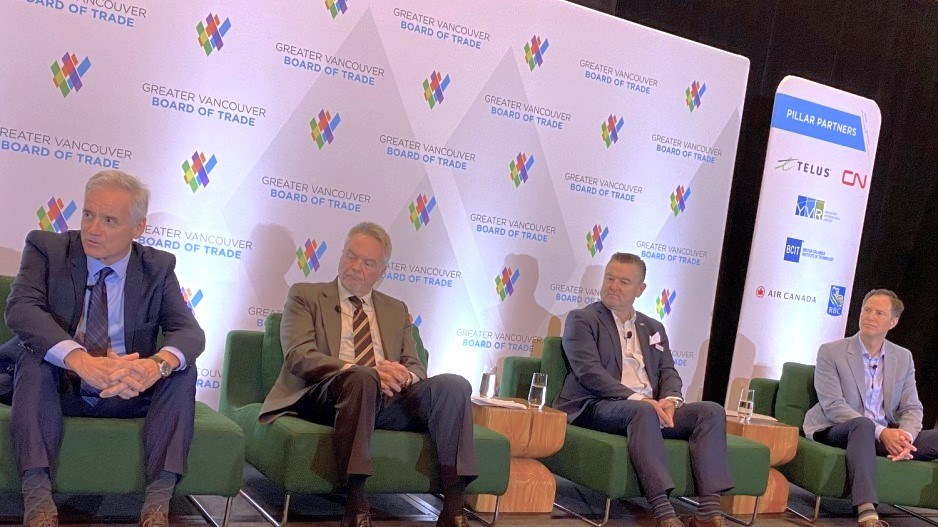

“In 2022, 91ԭ�� energy exports were $236 billion dollars, which is one-third of all Canada's exports,” Jeff Kucharski, senior fellow at the Macdonald-Laurier Institute, said Thursday at a Greater 91ԭ�� Board of Trade (GVBOT) energy forum.

“That's how important international energy markets are to Canada’s economy. And that’s set to grow significantly in the next couple of years as some major projects come online.”

“Since 2012, natural gas production has grown by 35 per cent, while lowering direct CO2 equivalent emissions by 22 per cent,” said Jack Middleton, senior advisor for the 91ԭ�� Association of Petroleum Producers (CAPP). "In that same timeframe, conventional producers have trimmed their methane emissions down by 34 per cent."

B.C.’s natural advantages as an energy producer and exporter include tidewater access and proximity to Asia, an abundance of liquids-rich natural gas, abundant clean hydro power, and hub of clean tech companies specializing in hydrogen fuel cell technology and carbon capture. And increasingly, First Nations in B.C. are proving to be important business partners in major energy projects, notably LNG.

“While the opportunities before us are significant, the transition to a low carbon economy also presents some challenging questions,” said Josie Osborne, B.C.’s minister of Energy, Mines and Low Carbon Innovation.

“Here in British Columbia, the oil and gas industry contributes significantly to our provincial economy and supports thousands of jobs. This industry is also responsible for about 50 per cent of (industrial) greenhouse gas emissions in B.C. and about 20 per cent of B.C.’s total emissions.

“And so, as the energy minister, I'm often asked: How can we meet our commitments to climate targets and environmental protection, but at the same time allow further LNG projects?”

The government’s plan is to reduce the greenhouse gas emission intensity of industries like natural gas and LNG through measures like increased electrification – something that will require a massive amount of public spending on additional electricity generation and transmission.

Osborne noted that, in March, when her government approved the Haisla First Nation’s Cedar LNG project, it also announced its Action Energy Framework, which includes emissions caps for the oil and gas sector.

The plan includes requiring new LNG plants to pass an emissions test and have a plan to be net zero by 2030.

B.C.’s clean energy policies are also encouraging new, clean energy projects, including what Osborne called the first stand-alone biodiesel refinery in Canada – the Tidewater Renewables project in Prince George.

“This is renewable diesel that will offer an 80 to 90 per cent reduction in carbon emissions compared to traditional diesel," Osborne said.

While environmentalists have warned B.C. could become a boneyard of stranded fossil fuel assets, as the world ends its reliance on fossil fuels, Kucharski suggested some of the projections about peak oil and gas demand may overly optimistic.

“Under almost any scenario, except for a net zero scenario, which is very ambitious, we’re going to need oil and gas -- hopefully with carbon capture and other technologies to capture the emissions,” Kucharski said.

"The Indo-91ԭ�� region will lead global demand for energy for at least the next several decades."

He also warned that if government get too ambitious with climate change pledges, it could generate public pushback.

The war in Ukraine and growing tensions between the West and China, and the impact it has had on energy trade, has resulted in some political leaders rethinking their priorities, with energy security and affordability now being a major concern.

“The biggest risk for the energy transition right now is losing public support, because of affordability issues,” Kucharski said. “As important as climate change is, we can’t afford to be so single minded about it that we ignore other important issues, like affordability and energy security.”

As if to underscore his point, the Government of Saskatchewan just today passed a bill that it says will enable it to stop collecting the federal carbon tax on the natural gas people use to heat their homes.

Even the Trudeau government has back-tracked on its own federal carbon tax by agreeing to exempt Atlantic Canada from the carbon tax for heating oil for three years.

While the demand for fossil fuels like LNG may indeed decline in Western countries – notably Europe – the market for LNG in particular can be expected to remain strong for many years to come.

“Japan, South Korea, China – they’re the largest LNG importers in the world, so there’s continued demand there and that’s why there’s a good future for B.C. LNG there.”

Despite the opportunity that provides for B.C.’s energy industry, there is some urgency in getting things done, said Bryan Cox – a former president of both the Mining Association of BC and the 91ԭ�� LNG Alliance and now director of external affairs and policy for Petronas Canada.

“We need to move at pace, folks,” he said. “This truly is a pivotal moment for British Columbia, for Canada, to get ourselves moving at pace. We need to be able to accelerate all of the things that you’re working on, including a coordinated natural gas and LNG value chain.

“We need a policy environment that can have pathways for things like electrification and carbon capture and storage.”

Mitigating the emissions from fossil fuels poses opportunities for B.C. companies in the "carbon management" space, said Paul Austin, partner in industrial and climate technology for Fort Capital Partners.

He noted two B.C. companies in that space -- Carbon Engineering, which was recently acquired for more than US$1 billion -- and Svante. Abating fossil fuel production provides a huge opportunity for companies like Svante, Austin said.

"The estimate for these (carbon capture) plants are between $300 million and $1 billion," Austin said. "And we're going to need hundreds of these things."