For several years now, B.C. has posted better than average GDP growth and employment numbers compared with the rest of Canada.

That may reverse in 2024, warns TD Economics.

One driver of B.C.’s economic growth in recent years has been multibillion-dollar energy projects that have kept thousands of 91ԭ��s working, even during a global pandemic.

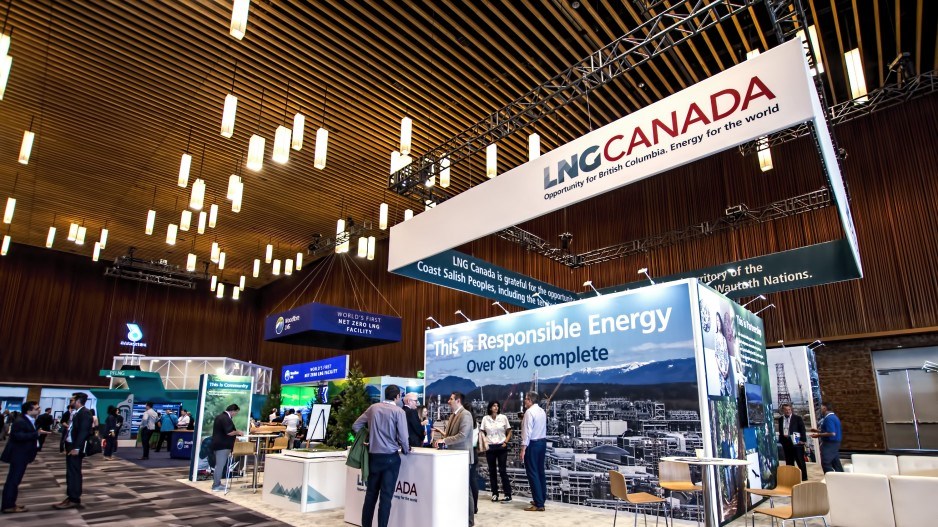

LNG Canada’s $40 billion liquefied natural gas project alone has been estimated to account for 0.5 per cent of B.C.’s recent GDP growth. It currently employs 6,500 workers, and to date has awarded $4 billion in contracts to B.C. businesses and contractors.

But the project is now 85 per cent complete, so by next year, many of those workers will be sent home – unless the partners behind the project agree to sanction a Phase 2 expansion.

TD Economics B.C. may lead the country in a negative way next year – in terms of economic contraction – partly due to the winding down of big energy projects like LNG Canada and the Trans Mountain pipeline.

There are other LNG projects in the queue that could keep B.C.’s economy firing on all cylinders for years to come. But compared with the U.S., Canada has been slow to get new LNG projects vetted, financed and under construction and has, as a consequence, missed windows of opportunity to sew up long-term contracts.

Sclerotic permitting and government indifference are being blamed for Canada missing the boat on a golden opportunity. An energy crisis in Europe and Asia has made the world suddenly hungry for 91ԭ�� natural gas, and all 91ԭ�� politicians seem to have to offer it is critical minerals that haven’t been mined yet and hydrogen that isn’t produced yet.

“We’ve had the European heads of state coming along, getting a nice handshake, a cup of coffee and sent home without any promises for anything,” Paul Sullivan, vice-president of upstream, midstream and LNG for Worley-Advisian, said last week at the global LNG2023 conference in 91ԭ��.

The absence of 91ԭ�� Prime Minister Justin Trudeau and federal Natural Resources Minister Jonathan Wilkinson at the conference did not go unnoticed.

Given the role natural gas can play in helping countries wean themselves off coal – including as a backstop to intermittent wind and solar power – some attending last week’s conference found it puzzling that the Trudeau government is not more supportive of the industry.

“Canada’s export of LNG from the West Coast is so important to going after our carbon issues in Asia, and it has to be supported … by the federal government,” said Sullivan.

“And I’m not sure that the federal government necessarily has understood how important their support will be. I do think the federal government has been very slow to move on the support of the LNG industry, perhaps because they haven’t grasped the importance of this in global re[1]duction of carbon dioxide.”

Nor was B.C. Premier David Eby at last week’s conference. But former B.C. premier Christy Clark was, and so was Alberta Premier Danielle Smith.

Clark, who is now an adviser for Bennett Jones LLP, was part of a diplomatic session at last week’s conference. She said potential international customers are puzzled by Canada’s apparent indifference to their energy needs.

“I can tell you there are people who are at this conference who have said to me, ‘We need Canada to help us. We need a reliable partner in natural gas supply. We know that you could be there for us, and we don’t understand why you’re not,’” Clark told BIV News.

“Countries like Japan, Korea, India -- they all need what we have. Some people think that, for some reason, we’re hoarding it. Literally, somebody used the word ‘hoarding it’ with me the other day. British Columbia has this incredible asset of natural gas. The world really needs it. But 91ԭ�� governments just make it next to impossible for people to get projects approved.”

Despite this perceived government indifference, some would-be LNG exporters still believe in B.C.’s potential. The CEO of Petronas last week talked up B.C.’s potential as an LNG exporter, despite his company’s negative experiences in the province.

Petronas spent $900 million positioning its $36 billion 91ԭ�� NorthWest LNG project, only to pull the plug on the project in 2017. Despite walking away from its own LNG project, Petronas kept the upstream natural gas assets it had acquired in B.C. and later became a 25 per cent partner in the $40 billion LNG Canada project.

“I think the unlocking of Canada’s gas resources would be immensely helpful for a world that really needs a fuel to transition away,” Petronas CEO Tan Sri Tengku Muhammad Taufik said. He added that demand for LNG in Asia is growing at two to three per cent each year.

“Where countries like China, Indonesia have already planned to move away from coal, you’re just naturally positioned to cater to these markets. And I think it would be a huge opportunity lost LNG Canada’s $40 billion project is 85 per cent complete, but might be expanded if we do not pivot to respond to these needs.”

Much was made last week about B.C.’s low-carbon advantage. Natural gas already produces half the CO2 emissions that coal does when burned for power. And thanks largely to electrification of natural gas and LNG processing, LNG produced in B.C. would have the lowest emissions intensity in the world.

Asked if he thought foreign buyers even care about LNG emissions intensity and would be willing to pay a premium for it,Taufik said they would.

“There have been customers who are specifically asking for carbon-abated cargoes,” he said.

As for the one LNG project that is being built – LNG Canada – it’s possible that the two-train plant could be doubled to four trains, which was what was originally approved by regulators.

Asked about that, Sullivan said he thought it was “inevitable” that the LNG Canada partners will sanction a second phase expansion at some point.

“The expansion projects are usually the ones that start to really get the profits moving,” he said.

In a keynote address, Alberta Premier Danielle Smith suggested that federal and provincial leaders do support an LNG industry. She said that in a recent meeting with Trudeau, the prime minister agreed that an LNG Canada Phase 2 expansion makes sense, because it could capitalize on the workforce already on site in Kitimat.

“We both agreed on the necessity of ensuring that Phase 2 of LNG Canada proceeds — that we optimize the current workforce at site,” Smith said.

She added that she also met with B.C. Premier Eby recently, and that they agreed to create a new working group between B.C. and Alberta on LNG.

“We both think one of the keys to making sure that we can have successful export projects is by using Article 6 in the Paris Accord … which allows for Canada to get international credit for reducing emissions abroad.”