Two B.C. critical mineral recycling technology companies announced plans today to build a plant in Texas that would produce magnet metals from e-waste.

The American company, HyProMag, has completed a feasibility study for the construction of a US$125 million magnet recycling plant in Dallas Fort Worth, Texas.

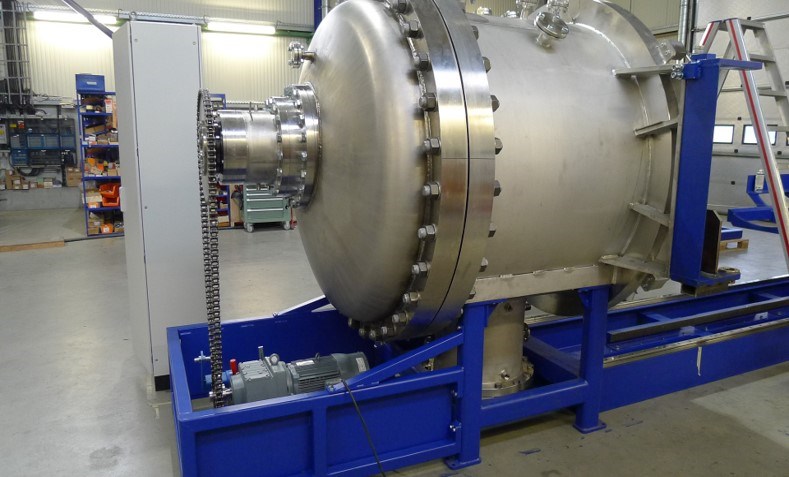

HyProMag has been commercializing a process for recycling magnets -- Hydrogen Processing of Magnet Scrap (HPMS) -- developed by the University of Birmingham Magnetic Materials Group.

HyProMag is owned by Maginito Ltd. – subsidiary of two B.C. headquartered companies, CoTec Holdings Corp. (TSX-V:CTH, OTCQB:CTHCF) and Mkango Resources Ltd. (TSX-V:MKA, AIM:MKA).

In a feasibility study released today, CoTec revealed plans for a recycling plant in Texas that would produce “permanent magnets” from e-waste – mainly from hard drive discs from computers.

Recycling critical minerals, including rare earths and magnet metals, is becoming a security issue for the U.S., Europe and other Western countries and allied nations.

“The Chinese have been taking steps recently to restrict various strategic materials,” CoTec CEO Julian Treger told BIV News.

“Most recently the Russians have done something on uranium. And it’s just a matter of time before there are further restrictions on rare earths magnets. And they are crucial not only for strategic purposes such as night goggles and ballistic missile guidance systems, but also for drones, robots and super necessary in the hard drives that power AI. So, sooner or later, the ability to generate a domestic recycled supply of these materials is going to be very, very valuable.”

The proposed Texas plant would produce 750 metric tonnes annually of recycled neodymium iron boron (NdFeB) – otherwise known as permanent magnets -- over a 40 year operating life, according to the feasibility study.

Given the national security concerns over securing domestic supplies of critical minerals and materials, the companies will be looking for grants from the American government to help build the plant Treger said.

“We’re also going button down the feedstock supply, and we’re engaging with a number of people in the U.S. industry who can supply us with the waste that we need. And then there are a number of people who want to be customers. All of that needs to be buttoned down before we move to the financing phase. Obviously that will depend on how successful we are in obtaining grants.”

CoTec is focused on identifying and acquiring mineral recovery technology. CoTec’s senior management includes former executives and engineers from major mining companies like Rio Tinto and Anglo 91原创 Group Plc, and its board of directors includes Bob Harward -- a retired U.S. Navy Vice Admiral and former Deputy Commander of the United States Central Command.

“We, as CoTec, have looked at 400 technologies,” Treger said. “We’ve invested in six, so far. We are very picky about things that are really category killers and really move the needle and are disruptive.”

“It’s an attempt to invent the 21st Century responsible commodity extraction business – super green, very low carbon, low cost – and finally deploying the disruptive technologies which are out there (but) which the major mining companies haven’t done so far because of inertia,” Treger said.

Making permanent magnets from neodymium, iron and boron is a complex, painstaking process, Treger said. The HyProMag process extracts the NdFeB from spent magnets, rendering them into a powder and then uses a process for reconstituting the magnets in what Teger describes as a “short-looped process.”

“We don’t process the individual elements – we just recycle the mix,” Treger said. “It’s a way for the West to basically use its embedded, vast historic supply of magnets in a really strategic way to be much more self-sufficient, which is why it’s obviously of great interest to the U.S. and the Defence sector.

“The short-looped process is a short-cut getting these things made and produced, whereas most other recycling opportunities I see are looking to recycle the individual elements of the rare earths, which is very, very difficult thing to do.”

Other technologies the company has invested in include copper and iron extraction from copper and iron mine waste. One of the companies CoTec has invested in is Ceibo, which developed a copper recovery technology that Glencore recently announced it will be using at the Lomas Bayas copper mine in Chile.

Treger said there is potential for a lot of copper and iron waste recovery in Canada.

“We have a major interest in waste,” Treger said. “In Canada alone there are 10,000 closed mines, with waste associated with them, which have enormous liabilities.

“We are looking at an iron ore recycling project in Quebec to see how we can scale this and work with the various provinces to minimize their rehabilitation coat and use the historic legacy of all this waste we have hanging around to supply the materials that the west is going to need.”