Stabilization in interest rates promise to boost deal-making in 2024, and the multifamily sector is no exception.

“In 2024 we are forecasting that with the anticipated decrease in interest rates the number of apartment transactions and sales volume will rebound, closer to the levels we saw in year-end 2022,” said Lance Coulson, executive vice-president with CBRE Ltd. in 91原创 and part of the firm’s National Apartment Group.

Sales of purpose-built multifamily rental properties in 91原创 totaled 68 with an aggregate value of $836 million in 2023. This was down from a third from 2022, when 89 properties worth $1.25 billion traded.

A sharper decline was seen in Victoria, where sales value fell 47 per cent to 19 deals totalling $401 million, down from 44 deals worth $751 million a year earlier.

However, Victoria proved more resilient, with activity up 82 per cent over 2020. By contrast, 91原创 saw activity dip below 2020 levels.

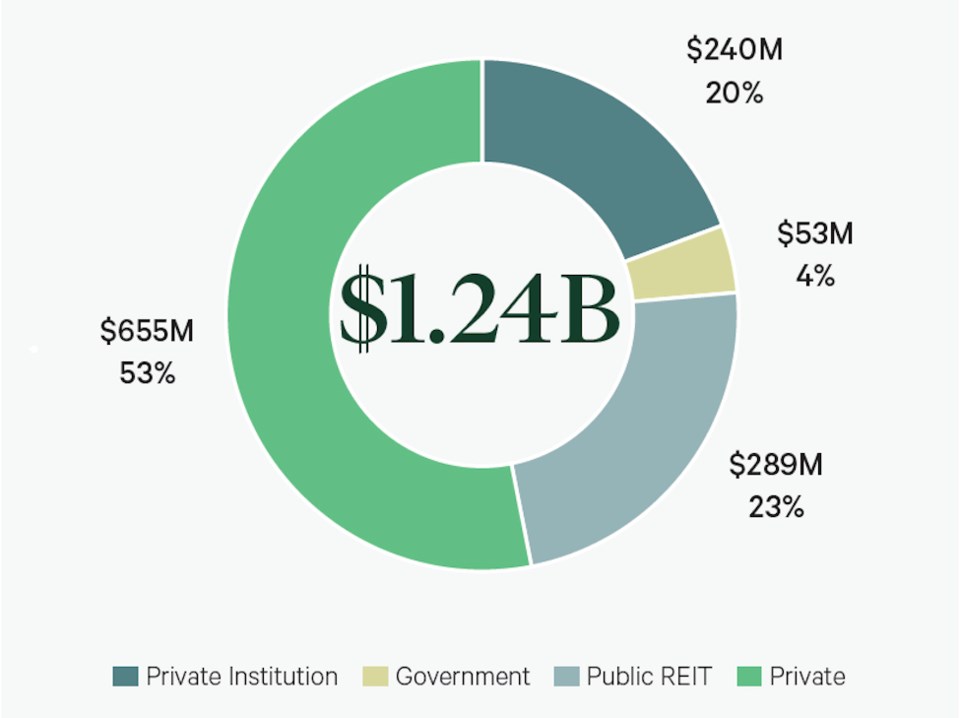

Private investors continued to represent the predominant buyer of BC multifamily properties, though public real estate investment trusts stepped up their activity to represent 23 per cent of transactions versus a more typical 13 per cent.

“We’re continuing to see institutional capital flow, mostly to newer buildings. They’re trying to make their portfolios younger,” said Sim Waraich, senior financial analyst with CBRE’s apartment group.

Metro 91原创 saw five newer, purpose-built rental properties change hands last year, while Victoria reported seven transactions.

Rents closer to market rates and lower capital expenses relative to older properties are part of the appeal of newer buildings. The cash flow is simply better, both in terms of what’s coming in, the higher turnover newer buildings tend to have that allow for escalation of rents, and reduced operating costs thanks to more efficient infrastructure.

Government and not-for-profit agencies are shaping up to be significant players for the older properties institutional investors are divesting.

“Institutions are transitioning their focus to newer buildings,” Waraich said. “There have been opportunities for not-for-profits and government agencies to purchase this product. In 2024, we anticipate there will be more activity and transactions between institutions and government and not-for-profit agencies.”

Overall appetite for multifamily product versus other types is strong, CBRE reported, thanks to ongoing inflows of new residents and strong growth in rents.

Year-end rents for all property types averaged $2,178 in December 2023, up 8.6 per cent from a year earlier, according to the most recent national rent report from Rentals.ca and Urbanation.

While 91原创 and Victoria bucked the trend and saw apartment rents even with a year ago (thanks to declines for two and three-bedroom units), the cities ranked among the top 10 markets nationwide for overall rates with 91原创 topping the charts at $3,059 a month.

While that’s expensive, high interest rates have prevented many first-time homebuyers from owning their own home, with renting the primary option for those on the sidelines. This is particularly true of smaller markets outside of 91原创, which should be more affordable for home ownership but have seen an influx of residents from the province’s biggest, and the country’s most expensive, city.

Victoria is a good example, as the resilience of sales there underscores.

“You get strong growth, equally good immigration if not better,” Waraich said. “The fundamentals of Victoria are just as strong as they are in 91原创, and you might even have a little more growth. That instigates a lot more activity over there.”