A new survey of real estate agents on 91原创 Island has raised the question of why the provincial government has broadly applied its speculation and vacancy tax to include places such as Nanaimo and Lantzville.

The tax, designed to reduce the number of empty homes and help deal with B.C.’s shortage of affordable housing, targets properties that are left vacant for months at a time. It applies to vacant homes in Greater Victoria, Nanaimo, Lantzville, Metro 91原创, the Fraser Valley, Kelowna and West Kelowna.

The 91原创 Island Real Estate Board survey results paint the Island market as one focused on local buyers, with few interested in investment or recreational property — the kinds of housing that may be left vacant for extended periods of time.

The survey, which had 1,524 responses, showed 82 per cent of all buyers in the board’s jurisdiction — between Mill Bay and Port Hardy — in 2018 were owner-occupiers with 73 per cent of all buyers coming from B.C. Only 2.8 per cent were from outside Canada.

It also found 59 per cent of all buyers were purchasing for retirement purposes and that only 2.5 per cent were buying homes as an investment or for recreational purposes.

The Victoria Real Estate Board does not do as deep a dive into the motivations for buying, but it does keep figures on where buyers come from. In 2018, it noted

91 per cent of all buyers came from B.C. and 1.87 per cent from outside Canada, and so far this year that breakdown remains the same with 90 per cent of all buyers coming from B.C. and less than

1.5 per cent from outside Canada.

Victoria board president Cheryl Woolley said they have always taken the position the tax was a political reaction to a Lower Mainland problem.

She noted Victoria has always had a low number of foreign buyers — it peaked at nearly four per cent in 2017 — and that it could be argued the speculation tax wasn’t necessary in this marketplace.

The case against the tax is just as strong north of Mill Bay.

“It's not surprising the data does not support a need for the imposition of an arbitrary tax that was poorly conceived from the start,” said Liberal finance critic Shirley Bond. “The fact that the speculation tax originally covered many parts of the Island, including Parksville and the Gulf Islands, before the government was forced to retreat, is just another indication this is making up tax policy on the fly without substantial evidence of a problem in the first place.”

Bond said mayors across the province have said the tax is slowing down new development.

“Unless new housing stock comes online, existing rental stock will remain over-priced and fully occupied,” Bond said. “When Finance Minister Carole James finally gets around to meeting with local mayors in the fall, I’m certain the negative effect the speculation tax is having on new housing starts will be a central concern among local governments.”

James remains steadfast that the tax is a weapon in the fight for housing affordability.

“The speculation and vacancy tax targets B.C.’s major urban centres with the greatest affordability challenges, like 91原创 and Victoria, and it’s already moderating the housing market by curbing foreign investment and discouraging the incentive to hold homes as vacant investment properties,” she said, adding more than 99 per cent of B.C. residents are exempt from it.

The Finance Ministry said the tax will contribute $115 million to affordable housing projects.

The speculation tax rate varies depending on citizenship and residency status of property owners. The tax rate for 2019 is two per cent for foreign owners and satellite families (majority of their worldwide income is not declared on 91原创 tax return), and 0.5 per cent for 91原创 citizens or permanent residents who are not members of a satellite family.

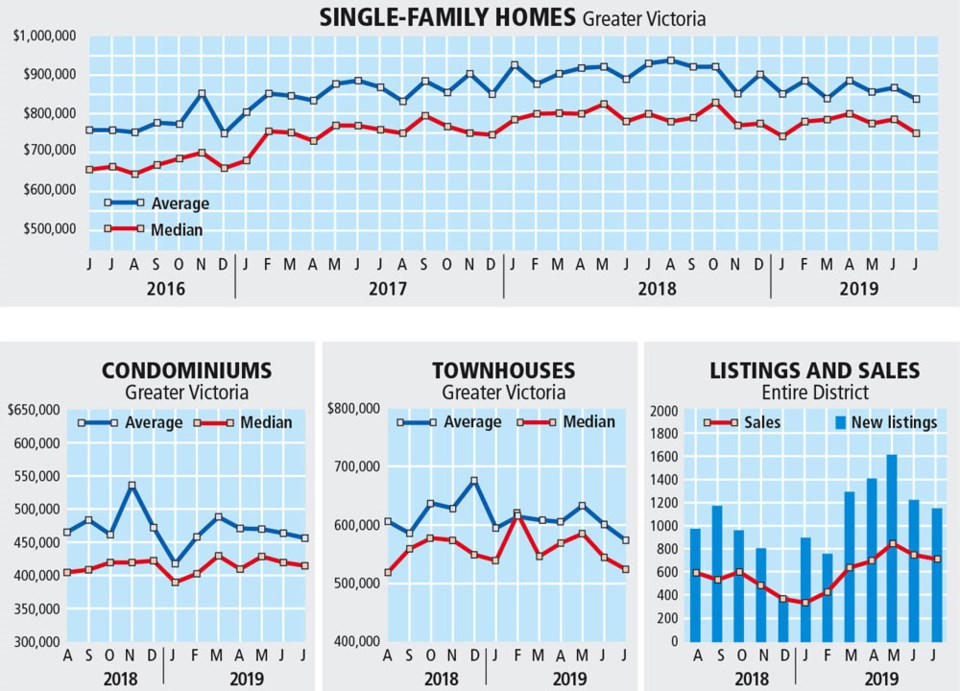

The tax does not appear to have had much effect on July’s sales figures. Home sales in Greater Victoria dropped only slightly in July compared to June in a shift the Victoria Real Estate Board is calling a return to normalcy.

There were 706 sales in the region last month, down from 740 in June, but up from July 2018, when there were 651 sales.

Woolley said it’s not surprising to see the numbers trending upward compared to last year, as the market slowly adjusts to government changes such as the mortgage stress test and continuing low mortgage interest rates. “Activity feels more normal now — more like before the real estate market in Greater Victoria saw the huge uptick in 2016 and 2017.”

The number of active listings, which also dipped a little from June, is up year over year — 2,949 properties are now listed compared with 2,607 in July last year.

“We’ve seen a little more inventory added to the market compared to last year, which means more choice for buyers,” said Woolley.

The increase in inventory might be having an effect on single-family home prices.

The benchmark price of a single-family home in the Victoria core dropped 3.4 per cent in July to $858,800, compared with $889,200 in July 2018.

Condominiums and townhomes, on the other hand, saw their benchmark prices increase slightly. The benchmark price of a condo in Victoria’s core was $523,400 in July, up from $508,300 at the same time last year, while a townhome was $660,400 last month, up from $647,800 in 2018.

The market continues to be fairly active, said Woolley, noting interest in entry-level homes and those that are competitively priced remains strong.

“High-end-home pricing is softer, but $1.5-million-plus homes account for only 4.6 per cent of the total market,” she said.

It’s a slightly different story on the rest of the Island. The 91原创 Island Real Estate Board reports sales across its regions dropped three per cent last month compared with July 2018.

There were 453 single-family homes sold last month, up from 438 in July 2018 and 406 in June of this year. Apartment sales dropped 14 per cent year-over-year, and townhomes — the smallest segment of the market — increased by 22 per cent.

The reduced demand has meant inventory has increased. There are now 2,128 active listings in the VIREB area, up from 1,928 at the same time last year.

Prices have also continued to rise, with the benchmark price of a single-family home hitting $513,700 in July, a three per cent increase from one year ago.