Greater Victoria’s real estate market, held back by low inventory, increasing interest rates and some buyer fatigue, is off to a slow start at what is usually its busiest time of year.

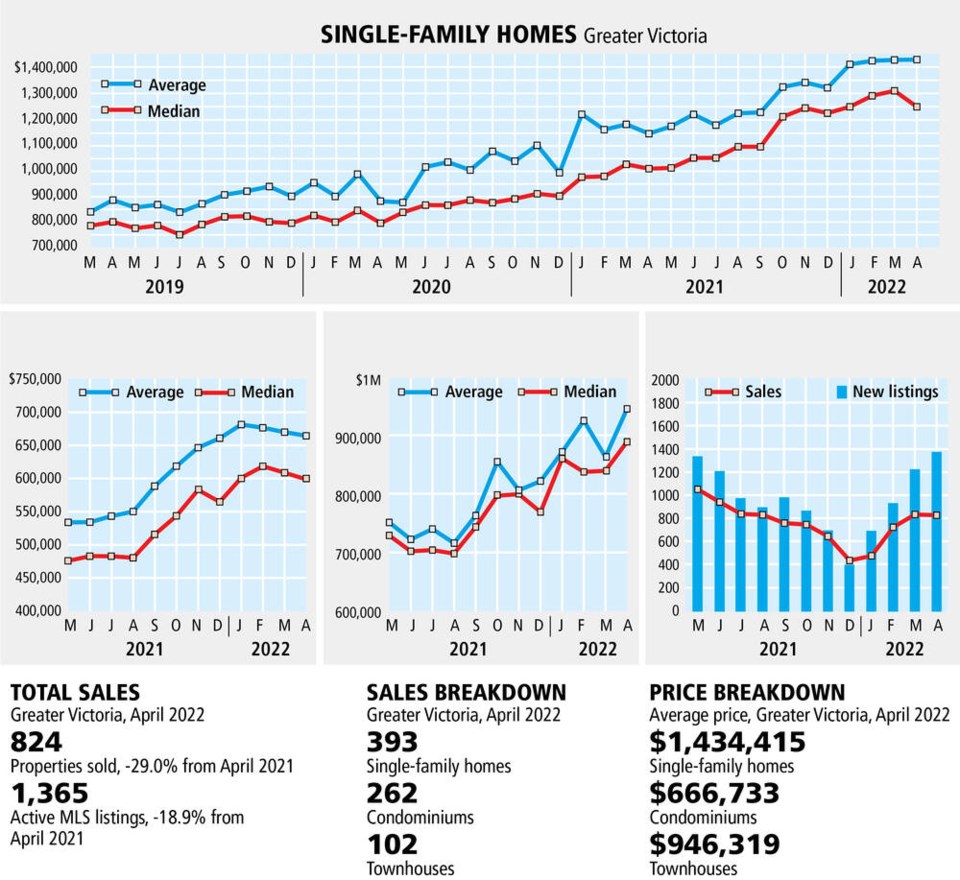

Numbers released Monday by the Victoria Real Estate Board showed sales in April were well below last year’s figures as just 824 properties changed hands, versus 1,116 in April 2021.

Board president Karen Dinnie-Smyth said there’s nothing surprising in the statistics given the headwinds facing the market.

“Borrowing costs, affordability erosion, construction constraints, general economic uncertainty, all of it comes into play,” she said. “It’s a combination of everything. I mean, we’re often used to seeing interest rates just go up and that’s one thing on its own, but when you add all of those compounding factors, plus the lack of inventory, it’s at a point where it’s getting more difficult for people to qualify.”

Dinnie-Smyth said it’s a little surprising that it happened in April. “Activity traditionally peaks over the course of the spring, and this year we have seen a gradual softening of the market,” she said.

But there’s nothing soft about home prices. They continued to rise in April.

The benchmark value for a single-family home in the region was $1.18 million in April, up from $1.14 million in March and well above the $903,600 mark set in April 2021.

The benchmark value for a condominium in the region last month was $643,000, up from $631,100 in March and $508,900 at the same time last year.

The benchmark value for a townhouse in April hit $808,600, up from $791,700 in March and $653,300 last year.

There was some positive movement when it comes to adding inventory to the marketplace, as the board’s figures show there were 1,365 active listings available at the end of April, up from 1,063 in March but still below last April’s 1,454.

But those numbers are all well below the historical average, leading to upward pressure on pricing.

“More inventory is always good, we would welcome more inventory coming onto the market because it does give buyers more opportunity,” said Dinnie-Smyth. “That obviously does help, but we still have those other factors (in play). If we started to see more inventory coming in, at the more affordable ranges, it might help.”

She said the market is still seeing multiple-offer situations happening at the more affordable price ranges, and that is likely to continue for the foreseeable future.

“We are currently experiencing a lessening of demand, but that does not mean we can lose sight of the fact that our housing market needs more supply,” Dinnie-Smyth said. “We must continue to encourage the government and stakeholders to focus on building more homes and not on creating new rules such as a cooling-off period that have nothing to do with getting more people into homes and risk upward pressure on pricing.”

Homebuilders broke records last year for productivity, but could not keep up with demand, as both real estate agents and builders pointed out the Island had definitely been “discovered.”

Builders, who are working flat out, have said they are still just trying to build their way out from under a housing-supply deficit.

Census data backs that up, with all regional districts on the Island reporting population increases since 2016 ranging from 9.4 per cent in Nanaimo to 6.3 per cent in the Cowichan Valley.

In Greater Victoria there was an 8.4 per cent increase in population over the last five years to 415,451, while the number of private dwellings in the capital region jumped to 198,435 from 183,562 over five years.