Despite inventory levels at an all-time low, Greater Victoria’s real estate market came close to matching a record number of sales in 2021 according to year-end numbers released Tuesday.

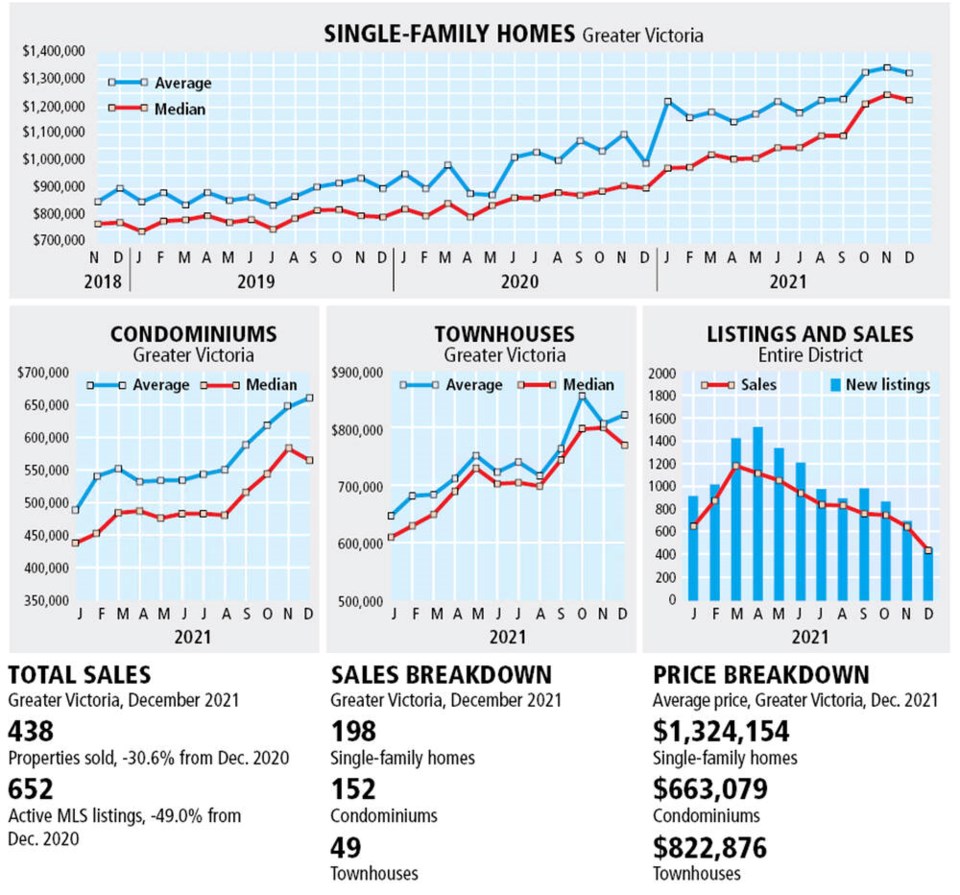

According to figures from the Victoria Real Estate Board, there were 438 properties sold in December, bringing last year’s total to 10,052, which is an 18.3 per cent increase over the sales in 2020, and just off the record of 10,622 set in 2016.

Outgoing board president David Langlois said 2021 was a little paradoxical as there were near-record sales while “we had zero inventory.”

Inventory levels ended the year with just 652 active listings for sale by the end of December, the lowest inventory seen in the last 25 years and a 49 per cent drop from the 1,279 active listings for sale at the end of December 2020.

Langlois suggested when you take out the number of listings that are likely to be redeveloped or torn down there are actually probably around 400 listings available in the region.

“The upshot is a 30 per cent increase year over year in prices,” he said.

The benchmark value for a single-family home in the region last month was $1.07 million up from $833,800 in December 2020, a 27.9 per cent increase year over year. The benchmark value of a condo in the region jumped 17.5 per cent over the last 12 months to $563,500 and townhomes jumped 25 per cent to 763,300.

And he expects demand to continue to outstrip supply and result in higher prices again in 2022.

“It’s just going to be more of the same,” he said. “Unless we see a significant interest rate shock, which may be the only thing that’s going to be able to tamp down the demand side. We’re not going to miraculously see a 200 per cent increase in housing starts because there’s no mechanism to allow for that.”

Langlois said some municipalities have started to look at ways to make it easier for new homes to be brought to market which is encouraging. “The situation we are now in is because of the deficit of supply that has compounded over the past decades of hesitation around growth.”

At the same time, governments appear to have been more focused on changing the process of how homes are sold in Canada by creating new rules for real estate transactions like the proposed cooling-off period, he said.

“These measures will do nothing to improve our market, nor will they increase consumer protection,” Langlois said.

“The process of how a home is sold is not the issue — homes will sell for what consumers will pay for them — using any sales process. The issue is how homes are brought to the marketplace and our huge lack of supply. Governments should expend their resources to address supply issues.”