The real estate market may have seen a slowdown in B.C.’s major cities, but the pressure on housing affordability has barely eased, according to .

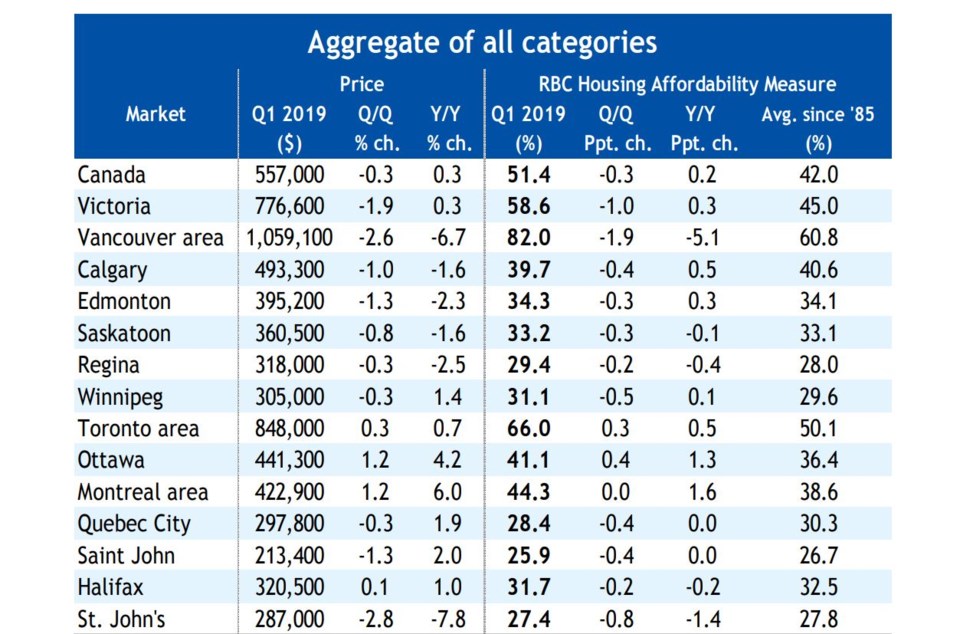

Taking the simple equation of average household income versus aggregate home price in each region, the bank found that Metro 91‘≠¥¥ was still the least-affordable housing market in the country, with Victoria coming in third, after Toronto.

In Metro 91‘≠¥¥, a buyer on an average household income would need to spend 82 per cent of their income to buy an aggregate-priced home (all property types), assuming a 25 per cent down payment. From another angle, only 12 per cent of Metro 91‘≠¥¥ites on an average household income with no other equity (aside from the down payment) could afford an aggregate-priced home of $1.059,100.

In Greater Victoria, only one in five households on a typical local income would be able to pay for an aggregate-priced Victoria home at $776,600 – the same proportion as in Toronto, said RBC. It would take 58.6 per cent of a Victoria resident's typical local income to buy a $776,600 home.

Overall, across the country, RBC reported that a buyer on an average 91‘≠¥¥ income would have to spend 52 per cent of their earnings on buying a national-average-priced home. This is the second consecutive improvement over the past two quarters, but still historically extremely high, said the bank.

Even though affordability was deemed “still dreadful” in the top three cities, RBC argued that market-cooling policy interventions have succeeded in preventing affordability from getting any worse. Report author and RBC senior economist Robert Hogue wrote, “Policy-engineered market downturns have succeeded at reversing some of the earlier massive affordability losses in [Metro] 91‘≠¥¥ and stabilizing the situation in [Greater] Toronto — though neither market is close to levels that ordinary 91‘≠¥¥ households can afford.”

Hogue added that there is “still room” for affordability to improve in Western Canada as the prices continue to soften over the year. “Despite signs of a cyclical market bottom emerging this spring, we expect home prices to remain under downward pressure for months to come in many western 91‘≠¥¥ markets.”