VICTORIA — The 2024 British Columbia budget includes new spending measures designed to ease high costs of living, while significantly boosting the province’s deficit. Here are some highlights:

THE DEFICIT

The 2024/2025 deficit is projected to rise to $7.9 billion, up from $5.9 billion in the updated 2023/2024 forecast.

SPENDING

Taxpayer-funded three-year capital spending almost doubles compared to the past three years, increasing to $43.3 billion, with big outlays on school, health and transport infrastructure.

COST OF LIVING

Families with children get a one-year 25 per cent bonus to their BC Family Benefit. On average, families get $445 more over the year. The measure, which starts in July, will cost $248 million and benefit 340,000 families, with 66,000 to get the benefit for the first time.

A one-time electricity credit will save households an average of $100 over a year, with the credit appearing first on the April bill.

Small and growing businesses benefit from an increase in the health tax payroll threshold.

HOUSING

A flipping tax will be introduced next year, targeting speculators who the province says are driving up housing costs. Profits will be taxed if a home is resold within two years of purchase. Revenue will go to homebuilding.

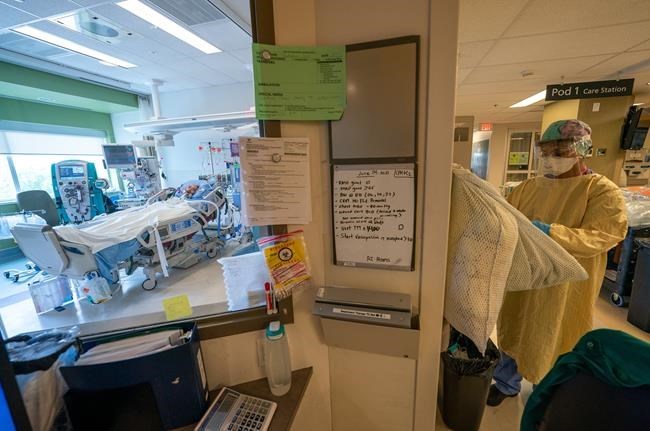

HEALTH AND SERVICES

From next year, a single cycle of free in-vitro fertilization treatment will be available to people, regardless of income, “who they love, or whether they have a partner,” says Finance Minister Katrine Conroy.

The budget earmarks $8 billion over three years to boost health, education, justice and public safety.

CLIMATE

Some $405 million will be spent over four years to better protect communities against climate emergencies.

This report by The 91įŁ┤┤ Press was first published Feb. 22, 2024.

The 91įŁ┤┤ Press