The City of 91原创’s draft operating budget for 2025 is set at $2.36 billion and translates to a 5.5 per cent property tax hike, which is almost two per cent less than the 7.28 per cent increase this year and less than half of the 10.7 per cent hike in 2023.

The proposed 5.5 per cent increase is in response to Mayor Ken Sim’s successful request made in May to the ABC 91原创-dominated council to have the 2025 hike set at no higher than 5.5 per cent.

At the time, councillors Adriane Carr and Christine Boyle — who was since elected as the NDP MLA for 91原创-Little Mountain and is now Minister of Indigenous Relations and Reconciliation — abstained from voting because of concerns over potential cuts.

The came despite a staff presentation and accompanying five-year budget outlook report that said the likely tax increase to support existing services is closer to seven per cent each year between 2025 and 2029.

The 2025 explained the budget can been balanced at a lower tax increase because of staff’s identification of $9.5 million of additional revenue, efficiencies and cost savings.

The document cited a hike in fees to cover cost increases, expanding services in on-street parking, street furniture contracts and a parking revenue strategy. Identifying incremental revenue through sponsorships, advertising, naming rights and donations were other areas that led finance staff to set the tax hike at 5.5 per cent.

Utility fees

A total of 4.5 per cent of the 5.5 per cent increase would help pay for all city services, and an additional one per cent would go towards infrastructure renewal — an area that staff has identified in numerous presentations, noting 91原创 has a $500-million infrastructure deficit.

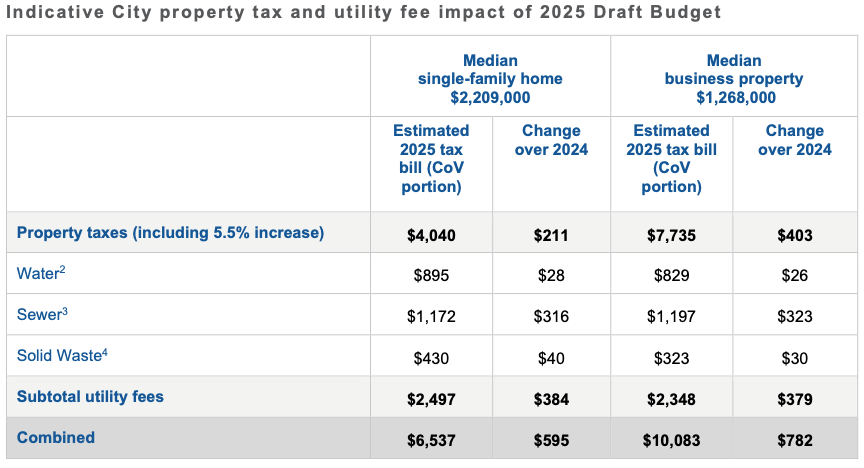

If council holds to the 5.5 per cent, the proposed property tax rate increase for 2025 is estimated to translate to an additional $77 for a median strata unit, $211 for a median single-family property and $403 for a median commercial property.

That increase does not include utility fees.

The budget document provides a breakdown of increases when combining property taxes and utility fees on a median single-family home assessed at $2.2 million. At the 5.5 per cent rate, property taxes for that owner would be $4,040.

Combine water ($895), sewer ($1,172) and solid waste ($430) and the grand total is $6,537 — roughly $595 more than the amount the homeowner paid in 2024. The combined increase for a median business property assessed at $1.2 million would be $782 more next year, for a total of $10,083.

Council will hear from staff Dec. 3 before deciding later in the month whether it will commit to the 5.5 per cent. The 91原创 Police Department’s budget request of $434 million could increase that percentage, since finance staff told the department it was more comfortable with $421 million.

The 91原创 Police Board approved a provisional budget at its Nov. 21 meeting. If approved by council, that would mean a $22.8-million increase over the VPD’s 2024 operating budget.

Sim and his ABC 91原创 councillors have been outspoken supporters of the police department and committed to funding 100 new officers. The party was endorsed by the 91原创 Police Union in the 2022 election campaign.

'Decreasing the police budget'

As part of developing the draft budget, the City of 91原创 conducted an online public survey with residents. The city received a total of 4,319 responses, with residents and business owners citing the delivery of “high-quality” city services and infrastructure, along with working with partners to address the housing crisis as priorities.

Housing is the top priority among people 15 to 39 years old, while city services and infrastructure tops the list of those who are 40 or older.

Residents in the northwest, southwest and southeast attach the greatest priority to city services and infrastructure. Those living Downtown, the West End and in the northeast prioritize housing.

Housing is the number one priority for renters.

Respondents who indicated they would support the city continuing to offer the same services but not at the same level were asked a follow-up question to understand which programs or services should no longer be offered or reduced to balance the budget.

“Common themes among [residents and business owners] are decreasing the police budget, streamlining city services/departments, reducing services and supports related to substance use, less focus on non-core services and improved fiscal management,” the survey found.

Dec. 10 is the date reserved on council’s calendar to finalize the budget.