VICTORIA — B.C. Hydro has borrowed most of the billions of dollars in dividends it has been forced to pay the provincial government over the last two decades.

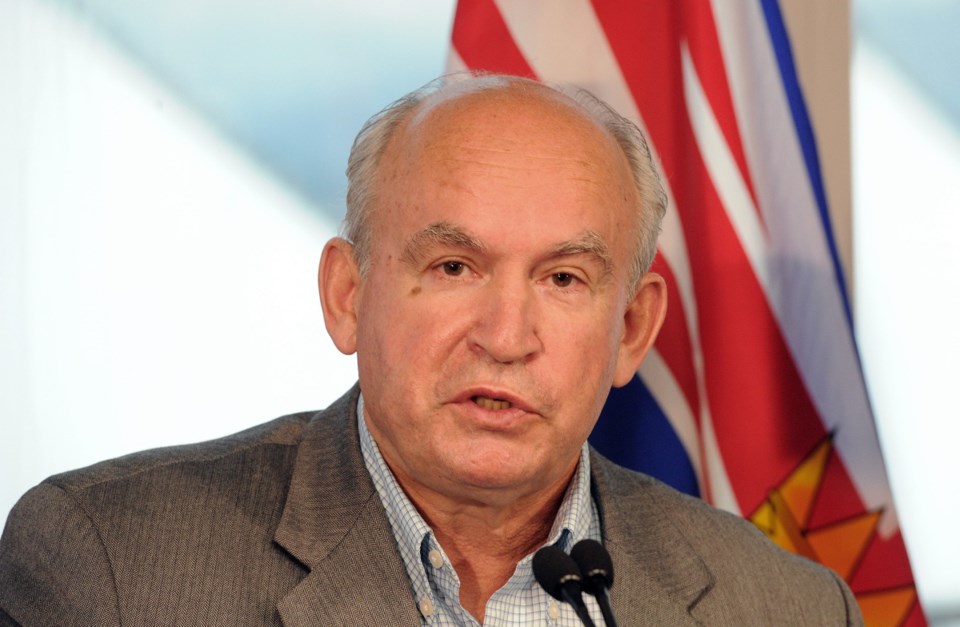

The cash-strapped Crown corporation has been locked into returning a share of its profits to the provincial treasury based on an old formula that was increasingly unaffordable, said Energy Minister Bill Bennett.

Businesses typically return a dividend to shareholders based on positive financial results. Hydro uses a formula that sees 85 per cent of its net income returned back to the government, though it can also choose to push costs into deferral accounts and give its finances the appearance of greater profitability.

The practice of taking dividends from Hydro was started by the NDP government in 1992, with the justification that Hydro provide a fair share of its revenue back to British Columbians.

“I would say the majority [of dividends] since 1992 has been borrowed,” Bennett said in an interview. “There were years both during our government’s time and during the NDP’s time, when they probably didn’t need to borrow money.

“But for many, many, of those years they had to borrow money to pay the dividend.”

Under the unique policy, dividends are tied to net income, which is tied to the value of B.C. Hydro assets. So the more B.C. Hydro spends upgrading infrastructure, the more dividends it must pay the provincial government, Bennett said.

Numbers supplied to The 91ԭ�� Sun by the Energy Ministry suggest Hydro’s debt would be $3.24 billion less than the current $15.4 billion, giving it more leeway to pay for its own projects, if it hadn’t had to borrow money to pay the government.

The Crown energy corporation has paid $5.4 billion in dividend payments since 1992, of which 60 per cent was borrowed money, energy ministry data shows.

The government uses the Hydro money to reduce what it has to borrow for its other provincial capital projects, such as highways, schools and hospitals.

Bennett said it’s an unsustainable practice that he’s committed to change in 2018 — a year after the next provincial election.

Critics, including B.C.’s auditor-general, have long accused the provincial government of being addicted to Hydro’s annual cash windfall, and have warned that Hydro is racking up debt and deferring costs in order to meet government’s financial expectations.

But neither government nor Hydro has previously admitted the extent to which Hydro has borrowed money to meet its provincial demands.

Others have accused the province of over-milking Hydro’s profits, which pushed the corporation to hike consumers’ electricity rates to afford its continued operations. Hydro rates are set to rise 28 per cent over the next five years.

Former auditor-general John Doyle noted Hydro has simply deferred costs into future years, which “creates the appearance of profitability where none actually existed” — allowing Hydro to meet its obligations to government.

“I will state on the record that it seems to me that the sole purpose of this whole exercise is so that a dividend can be paid to the province,” Doyle told MLAs during a 2011 meeting.

Bennett said the government’s Hydro dividend is not sustainable and has meant that essentially “the [Hydro] ratepayer has been loaning money to the taxpayer.”

Bennett said he heard concerns about Hydro’s borrowing shortly after taking over as energy minister in 2013 and has moved to change the dividend formula.

The changes will let Hydro keep $3.3 billion it would otherwise have had to funnel back to the government over the next 10 years, which will allow Hydro to borrow less money to fund projects like the recently approved $8.7-billion Site C dam on the Peace River in northern B.C.

But the changes don’t come into effect until after the 2017 provincial election.

The goal, Bennett has said, is to slowly wean government off its reliance on ever-increasing Hydro payments. The Hydro dividend will be reduced to zero between 2018 and 2021 and stay there until the energy corporation’s debt-to-equity ratio improves, the government has said.

Instead of Hydro’s dividend payments being calculated using the value of its assets — which increases by billions whenever Hydro upgrades its equipment or builds new power-generation facilities like Site C — the government will limit growth in the dividend to the rate of inflation, said Bennett.

“It’s not like Hydro is not going to pay dividends to government, they are, and they’ll continue to pay a lot of money to government,” said Bennett. “But that net income and dividend will not go up the way it would have if we had continued to calculate net income on the basis of assets and service.”

Bennett said he wasn’t blaming the NDP for creating the original dividend, and that the Liberal government has since taken Hydro’s money as well.

“It was started by the NDP, but we went along with it,” said Bennett. “We did the same thing as they were doing.”

A 10-year plan to invest $1.7 billion annually in Hydro power upgrades would also have dramatically grown the value of Hydro’s assets and led to an unaffordable high dividend, said Bennett.

“What we’ve had since 1992 in my view is a cross subsidization by the ratepayer to the taxpayer. Hydro’s OK, they aren’t broke or anything, or in the red or anything like that. But what it would have led to if we left the system alone … you would have put Hydro in a very, I think, precarious position.”

NDP critic Adrian Dix said it’s “misleading” to say Hydro is borrowing to pay its dividend when it’s all provincial money borrowed at the same rate. He said Bennett has long been trying to blame Hydro’s problems on the policies of the NDP government in the 1990s.

“What Mr. Bennett politely ignores is the impact of their [Liberal] policies,” said Dix.

“They’ve been buying high and not able to sell the power, that’s their problem. They’ve been using deferral accounts as bank accounts for the provincial government, that’s their problem …

“What they are doing is confusing the issue to explain the government’s own tortured mathematics around its budgets and Site C.”

��